Medicare was created to provide affordable healthcare coverage to seniors 65 and over and those younger than 65 with disabilities. The Medicare program is divided into multiple parts: Part A, Part B, Part C, and Part D. Understanding what each of these parts covers and what they cost is crucial in determining if you have the right plan going into 2022.

Review the Coverage

You need to consider your own healthcare needs and review the coverage provided by each plan. This is highly necessary as you’ll need a plan that can adequately cover your healthcare needs—having a plan with the wrong type of coverage is nowhere near beneficial and can be a waste of money.

Medicare Part A and Part B cover inpatient and outpatient hospital and medical procedures such as hospice care, durable medical equipment, skilled nursing facility care, preventive screenings, etc. If you have healthcare needs relating to this, then Original Medicare may be suitable for you. However, keep in mind that to enroll in other parts of Medicare, you will need to be enrolled in Original Medicare first.

If you have high out-of-pocket costs with Original Medicare, you can purchase what is known as a Medicare Supplement (Medigap) plan. These plans can only be purchased when enrolled in Original Medicare as they are designed to supplement Original Medicare by covering costs such as coinsurance, deductibles, copayments, and other costs.

A Medicare Part D plan is also a good option if you take prescription drugs regularly. There are different types of Part D plans, so it is important to ensure the Part D plan you choose will cover the prescription drugs you take.

Suppose you need a plan that provides the same coverage as Original Medicare, may include prescription drug coverage, and might even include additional coverage, all under a single plan. In that case, Medicare Advantage (Part C) can be beneficial. Like Part D, Medicare Advantage plans will vary, so comparing your options is important when it comes to finding a Medicare Advantage plan that works for you.

Review Plan Costs

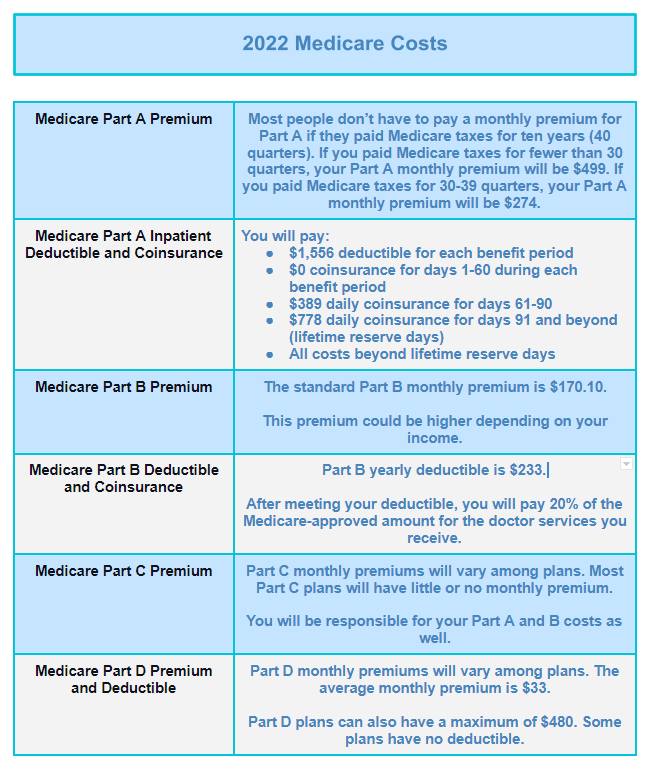

Not only does each part of Medicare vary in coverage, but they will vary in costs. The cost of these plans is also subject to change each year, so paying attention to your plan and the premiums, deductibles, and other expenses that are typically involved is extremely important.

At Medicare With Jake, we help individuals find the best Medicare plan that suits their needs. To learn more about your Medicare options and which plan is best for you, give us a call today!